tacoma sales tax calculator

Look up a tax rate. Integrate Vertex seamlessly to the systems you already use.

Auto Sales Tax Calculator Buy A Vw Near Marysville Wafacebook

You can print a 103 sales tax table here.

. Counties cities and districts impose their own local taxes. The average cumulative sales tax rate in Tacoma Washington is 1015. The 103 sales tax rate in Tacoma consists of 65 Washington state sales tax and 38 Tacoma tax.

There is base sales tax by Washington. US Sales Tax Washington Pierce Sales Tax calculator Puyallup Tribe - Tacoma. The County sales tax rate is 0.

There is no applicable county tax or special tax. Input the amount and the sales tax rate select whether to include or exclude sales tax and the calculator will do the rest. Use tax is paid at the time a vehicle is registered with the Department of Licensing if sales tax was not paid at the time the vehicle was acquired by the current owner.

Counties cities and districts impose their own local taxes. A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Sales Tax Calculator Sales Tax Table.

File Pay your BO gambling andor Utility Tax online with FileLocal. There is no applicable county tax or special tax. The results are rounded to two decimals.

Calculator for Sales Tax in the Puyallup Tribe - Tacoma. The Washington sales tax rate is currently 65. For assistance click contact us.

You can find more tax rates and allowances for Tacoma and Washington in the 2022 Washington Tax Tables. If you have tax rate as a percentage divide that number by 100 to get tax rate as a decimal. Fill in price either with or without sales tax.

Get immediate access to our sales tax. The current total local sales tax rate in Tacoma WA is 10300. The sales tax added to the original purchase price produces the total cost of the purchase.

Use our simple sales tax calculator to work out how much sales tax you should charge your clients. You can print a 103 sales tax table here. Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase.

Fill in price either with or without sales tax. Find list price and tax percentage. Business income is reported under a tax classification depending on the type of business activity.

The December 2020 total local sales tax rate was 10200. The sales tax rate for Tacoma was updated for the 2020 tax year this is the current sales tax rate we are using in the Tacoma Washington Sales Tax Comparison Calculator for 202223. The results are rounded to two decimals.

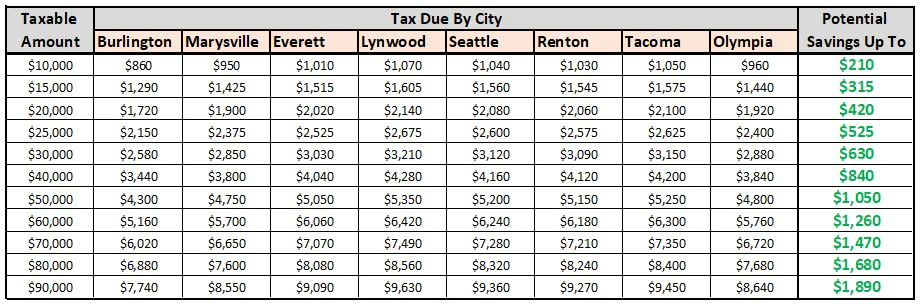

Within Tacoma there are around 31 zip codes with the most populous zip code being 98404. Youll find rates for sales and use tax motor vehicle taxes and lodging tax. How to Compare Sales Tax in Tacoma Washington.

Look up 2022 sales tax rates for Lake Tacoma Illinois and surrounding areas. When searching your next new vehicle not only do we have a Toyota to fit every lifestyle but some of the best deals youll find in Washington. Sales Tax Calculator.

There is base sales tax by Washington. If you conduct multiple activities it may be necessary to report under several BO tax classifications. This includes the rates on the state county city and special levels.

Tax rates are provided by Avalara and updated monthly. This is the total of state county and city sales tax rates. Washington has a 65 statewide sales tax rate but also has 105 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 2368 on.

Divide tax percentage by 100 to get tax rate as a decimal. Calculator for Sales Tax in the Tacoma. The Tacoma Sales Tax is collected by the merchant on all qualifying sales made within Tacoma.

Tacoma in Washington has a tax rate of 10 for 2022 this includes the Washington Sales Tax Rate of 65 and Local Sales Tax Rates in Tacoma totaling 35. Search by address zip plus four or use the map to find the rate for a specific location. California State Sales Tax.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. The sales tax rate for Tacoma was updated for the 2020 tax year this is the current sales tax rate we are using in the Tacoma Washington Sales Tax Comparison Calculator for 202223. The motor vehicle saleslease tax of three-tenths of one percent 03 on motor vehicles also applies when use tax is due on a vehicle.

If this rate has been updated locally please contact us and we will update the sales tax rate for Tacoma Washington. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Tacoma WA. See Inventory Get A Quote.

Ad Automate Standardize Taxability on Sales and Purchase Transactions. Tacoma is located within Pierce County Washington. Use this calculator the find the amount paid on sales tax on an item and the total amount of the purchase.

The Tacoma sales tax rate is 38. As far as sales tax goes the zip code with the highest sales. Here at Foothills Toyota our priority is to provide the best possible customer experience.

The Tacoma Washington sales tax is 1000 consisting of 650 Washington state sales tax and 350 Tacoma local sales taxesThe local sales tax consists of a 360 city sales tax. Multiply the price of your item or service by the tax rate. Just enter the five-digit zip code of the location.

The sales tax jurisdiction name is Pierce which may refer to a local government division. Maximum Possible Sales Tax. US Sales Tax Washington Pierce Sales Tax calculator Tacoma.

This would happen if a vehicle was. In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax. Average Local State Sales Tax.

How to Calculate Sales Tax. Maximum Local Sales Tax. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Tacoma WA.

Then use this number in the multiplication process. Skip to main content. Groceries are exempt from the Tacoma and Washington state sales taxes.

Use our Tax Rate Lookup Tool to find tax rates and location codes for any location in Washington. Sales tax is calculated by multiplying the purchase price by the sales tax rate to get the amount of sales tax due. The minimum combined 2022 sales tax rate for Tacoma Washington is 103.

6 75 Sales Tax Calculator Template Tax Printables Sales Tax Tax

Washington State How Much Tax Do We Usually Pay While Working In Seattle Quora

Washington Sales Tax Small Business Guide Truic

Used Toyota Tacoma For Sale In Florida Cargurus

Sales Tax Calculator Foothills Toyota

Sales Tax Calculator Foothills Toyota

Sales Tax Calculator Foothills Toyota

Auto Sales Tax Calculator Buy A Vw Near Marysville Wafacebook

2021 Toyota Tacoma Monthly Car Payment Calculator U S News World Report

States With Highest And Lowest Sales Tax Rates

Washington Income Tax Calculator Smartasset

8 5 Sales Tax Foothills Toyota

Sales Tax By State Non Taxable Items Taxjar

Sales Tax Calculator Foothills Toyota

Washington Income Tax Calculator Smartasset

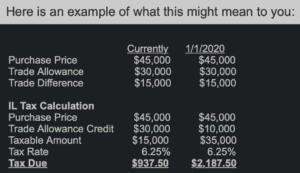

Illinois Car Sales Tax Countryside Autobarn Volkswagen